We Help Small Businesses

Making Access to Business Capital as Easy as ABC™

Business Loans

Relief Loans

Work With a Team of Small Business Champions

Choose the loan program that’s right for you

SBA 504

One of the best options for America’s small businesses with low down payments—as low as 10% for commercial real estate.

Community Lending

Small business loans made available from $5,000 to $350,000; offering funding that is made available through public and private programs.

Small Business Loans Help Meet These Needs

Own Your Building for Your Business

Current SBA 504 Effective Rates*

6.69% (25-year fixed)

6.71% (25-year REFI)

6.76% (20-year fixed)

6.69% (20-year REFI)

6.58% (10-year fixed)

*as of 04/11/2024

We Make the Loan Process as Easy as ABC

A

Application

AmPac and Bank Partner (if real estate or equipment loan) meet the business owner to understand the business and financing objectives and begin collecting financial information.

B

Business Review

Business completes a checklist of financial information including personal and business tax returns and/or business plan and projections coupled with additional review procedures.

C

Closing

Bank and AmPac ensure that all company operating documents are collected and then close and fund the loan.

Get Started and Apply!

We Make the Loan Process as Easy as ABC

A

Application

AmPac and Bank Partner (if real estate or equipment loan) meet the business owner to understand the business and financing objectives and begin collecting financial information.

B

Business Review

Business completes a checklist of financial information including personal and business tax returns and/or business plan and projections coupled with additional review procedures.

C

Closing

Bank and AmPac ensure that all company operating documents are collected and then close and fund the loan.

Get Started and Apply!

We Make the Loan Process as Easy as ABC

A

Application

AmPac and Bank Partner (if real estate or equipment loan) meet the business owner to understand the business and financing objectives and begin collecting financial information.

B

Business Review

Business completes a checklist of financial information including personal and business tax returns and/or business plan and projections coupled with additional review procedures.

C

Closing

Bank and AmPac ensure that all company operating documents are collected and then close and fund the loan.

Get Started and Apply!

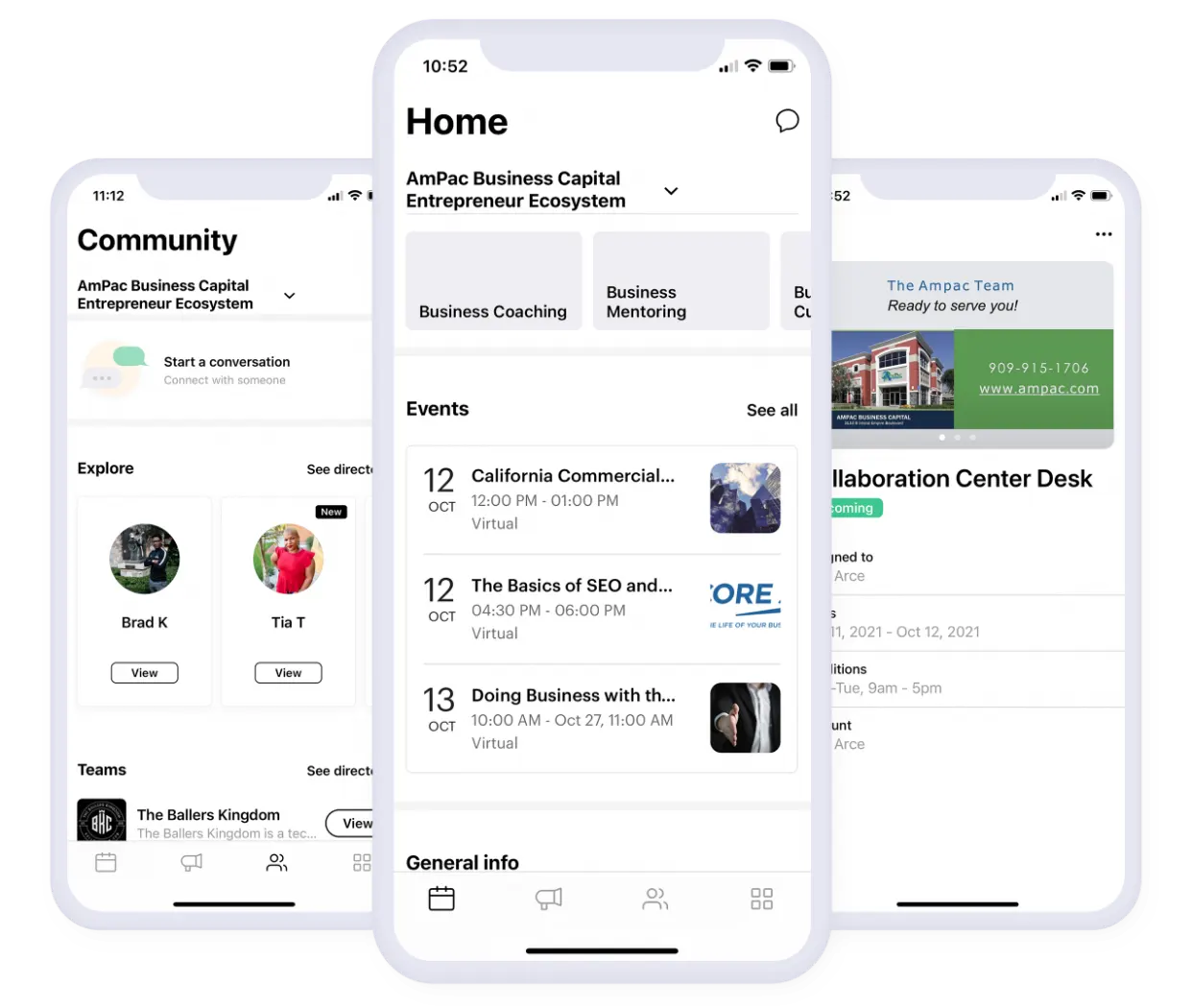

Join a community of over 1600 businesses professionals!

- Book meeting spaces

- Post, market and engage professionals for free

- Explore the resources, coordinate growth support sessions, and network in a digitally connected local entrepreneurial space

- Join The Entrepreneur Ecosystem and connect your business community!

Co-Working Space

This co-working space is your community center for collaboration, creative idea sharing, and mastermind activities. We provide communal desks and chairs in an open space format, as well as conference room space options, and private offices. This facility is a resourceful space for local business-related organizations to have board meetings and summit-style events.

Upcoming Events

We are always looking for ways to host and work with the community. Join the community events.

AmPac Business Capital Entrepreneur Ecosystem Advancing Impact Growth Hour

Join the AmPac Business Capital Entrepreneur Ecosystem Advancing Impact (ABCEEAI) community hour! We are available here to help you!Need help completing your loan application? Need guidance on if an AmPac loan product is right for you? Need assistance in being pointed to the resources you need to grow your businessWe are here for you! Join…

Horario de Operaciones Asociacion de Emprenedor@s

Horario de operaciones Asociacion de Emprenedor@s organizado por AmPac’s Entrepreneeur Ecosystem! ¡Los consultores de la Asociación de Emprendedor@s estarán disponibles previa reservacion tanto virtualmente como en persona a traves de el Ecosistema Emprended@r de AmPac! “Nuestra misión es educar, motivar, empoderar y desarrollar las habilidades de liderazgo y negocios de la de la comunidad hispana…

AmPac Business Capital Entrepreneur Ecosystem Advancing Impact Growth Hour

Join the AmPac Business Capital Entrepreneur Ecosystem Advancing Impact (ABCEEAI) community hour! We are available here to help you! Need help completing your loan application? Need guidance on if an AmPac loan product is right for you? Need assistance in being pointed to the resources you need to grow your business We are here for…

Uplifting Communities,

Strengthening Families, & Advancing Entrepreneurial Dreams

Local Business Success Stories

Uplifting Communities,

Strengthening Families, & Advancing Entrepreneurial Dreams

Local Business Success Stories

Donate to AmPac as We Further the Community

Every donation goes to furthering our mission of serving the community by allowing us to invest in advancing entrepreneurial dreams at all stages of growth!

AmPac Business Capital News and Press Releases

Why State and Federal Contracting Might Make Sense for Your Business

| News

Leona Stewart’s Triumph

| Success Stories

Building Success: Duane Cano’s Story of Expansion with AmPac’s SBA 504 Loan

| Success Stories

AmPac Wishes to Thank its Partners